Do’s and don’ts of time sheets…

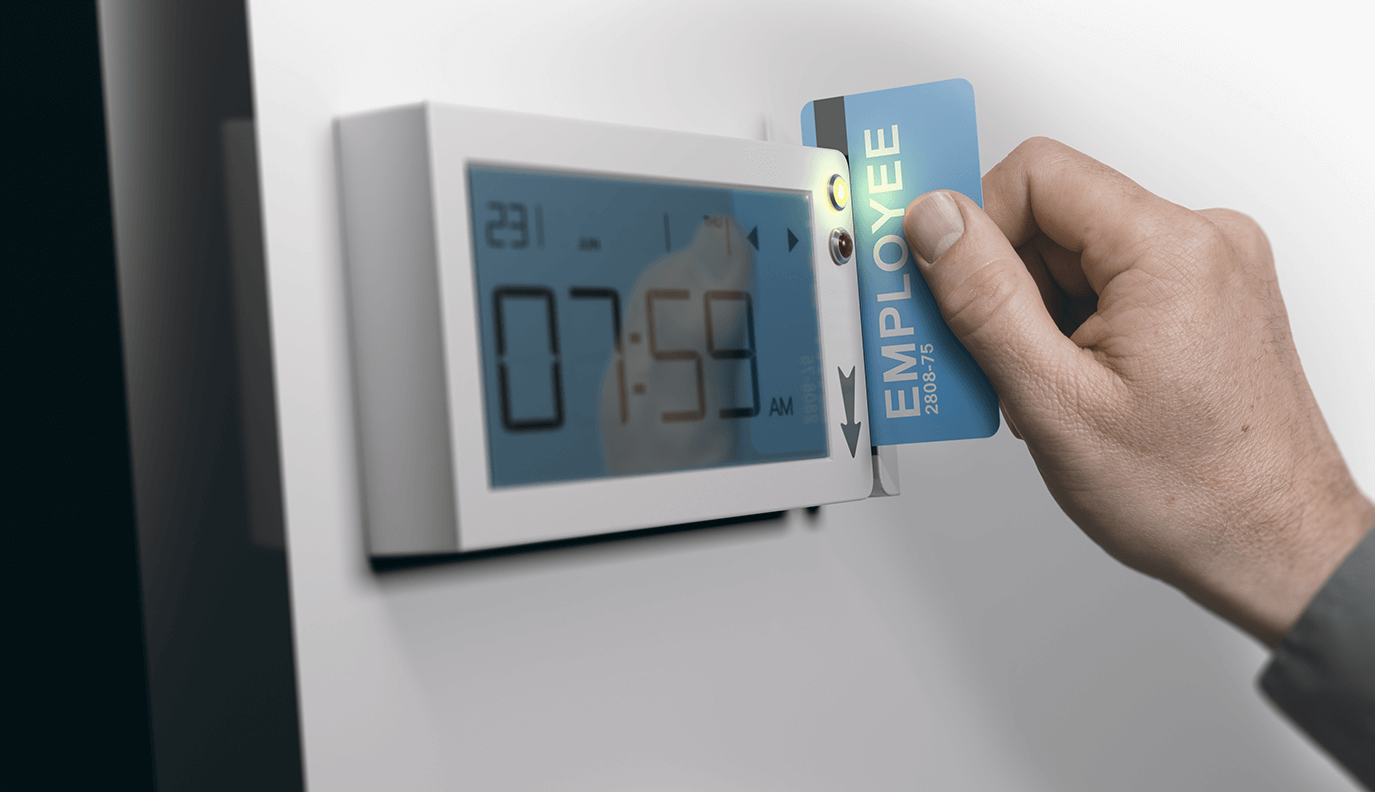

Like many employers today, you probably use an automated timekeeping system that lets employees clock in and out. That system could be web based or at the time clock terminal. If you’re using a manual timekeeping system, your employees complete paper time sheets, which they should then submit in time for payroll processing. Complications can arise when employees do not clock in or out or do not turn in their hours worked in a timely manner. Below are do’s and don’ts for these situations.

What You Can Do

- Be aware that under the Fair Labor Standards Act, the employer is ultimately responsible for maintaining accurate timekeeping records. As a manager, you can either track your employees’ work hours yourself or give your employees the tools to track their own time or both.

- Contact the employee to obtain the missing timekeeping data. Verbal messaging may be fastest, but if there is enough time, aim for written communication (such as email) because it gives you a paper trail.

- Determine, or estimate as best as you can, the hours worked if you cannot reach the employee. Ordinarily, you should be able to tell whether the employee worked his or her full scheduled shift. You’re also allowed to change the employee’s timekeeping data, regardless of what the employee turned in, as long as the modified information is correct.

- Discipline the employee, if applicable, for failing to follow your timekeeping procedures. Make sure any disciplinary actions you take are consistent with company policy and applied without discrimination.

What You Cannot Do

- Do not withhold the employee’s pay, as the FLSA and state wage-payment laws require employers to pay employees for all hours worked. Typically, if the employee was scheduled to work, managers can tell whether the job was done. If the work was performed, the employee must be paid accordingly. While you can discipline the employee for not abiding by your timekeeping rules, you cannot withhold pay as punishment.

- Do not overlook possible exceptions, such as telecommuting or remote work. For example, the case of Jackson v. Corrections Corporation of America shows that the burden of timekeeping isn’t always on the employer. Per the California Public Agency Labor & Employment Blog, the court held that “where a non-exempt employee is allowed to work from home; and the employer cannot practically track the employee’s hours worked, the responsibility for accurate timekeeping falls on the employee.”

The court found that Jackson failed to sufficiently prove her claim for unpaid overtime because she did not complete the time sheets her employer gave her. Nor, did she clarify the nature of the work she allegedly performed at home. However, according to the California Public Agency Labor & Employment Blog, the employer likely violated the FLSA’s record-keeping rule. The employer, didn’t keep accurate timekeeping records.

Copyright 2024

Why Atlantic Payroll Partners

The biggest payroll companies probably won’t have time for your business. It’s that simple, you’ll be a number. At Atlantic Payroll Partners, you’ll be the opposite. We’ll know more than your name; we’ll know the names of your children and their birthday’s as well. We will know you.

We’ve been helping Florida business by managing their payroll and providing workers' compensation quotes for ten years. We help keep payroll cost affordable by provided transparent PEO payroll quotes that allow you to plan your budget accordingly. Like the big payroll companies, you can manage your payroll and payroll timekeeping with us, while reaping the benefits of PEO risk management.

Thinking about payroll outsourcing can be scary. Make sure you know what to expect from payroll outsourcing providers; to make the best decision for your business. In addition to offering payroll, and workers' comp quote we offer: Human Resource consultations, Accounting services, and benefits such as, 401ks and Healthcare plans.