Updated January 20, 2021

The following is intended as a guide, this is not a replacement for official tax or accounting advice.

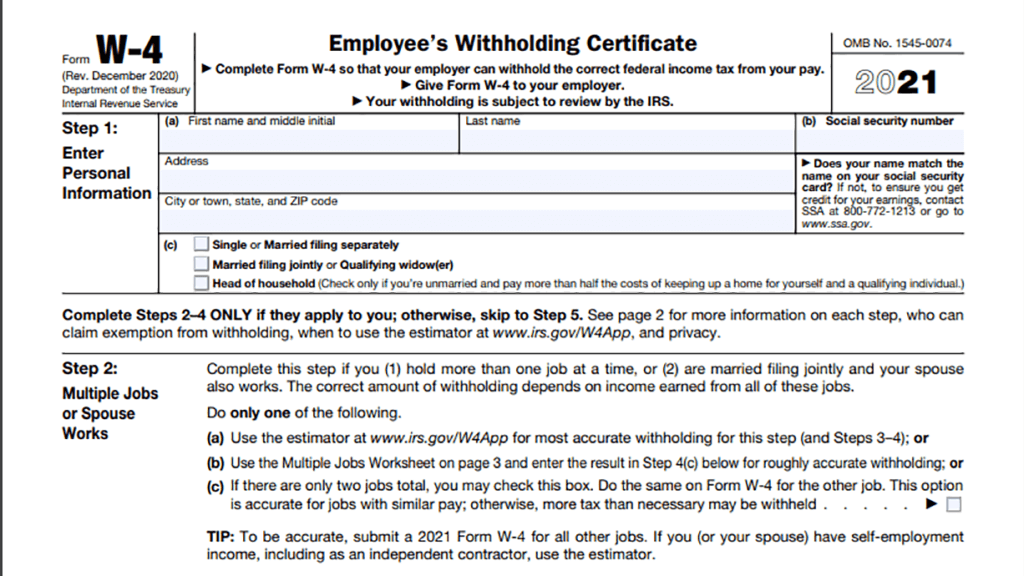

The 2021 Form W-4 is slightly different than the most recent update from the overhaul that took place on 2020. For that reason, it is important that you use the latest edition of the Form W-4 worksheet for accuracy.

Notable changes: On page 3, Step 4(b) on the “Deductions Worksheet”, on step number 2 you will notice that the amounts of the deductions have slightly increased. In 2020 Married Filing Jointly or Qualified Widow(er) is now $25,100 it previously was $24,800. The amounts for Head of Household, and Single or Married filing separately have changed as well.

On page 4 the Annual Taxable Wage & Salary Table has also been updated.

The IRS noted, “Allowances are no longer used for the redesigned Form W-4 to increase transparency, simplicity and accuracy. In the past, the value of a withholding allowance was tied to the amount of the personal exemption. Due to changes in law, currently you cannot claim personal exemptions or dependency exemptions.”

According to the IRS, a few of the visual changes that were made in the last draft shared include:

- It is now a full page.

- There are no withholding allowances (which is why the title of the form changed to “Employee’s Withholding Certificate”).

- Steps 1 through 5 to guide employees through the form.

- Instructions, worksheets, and tables follow the first page.

Probably the biggest question for both companies and employees is “Does everyone have to fill out the new form?” The answer, according to the August guidance, is no. The IRS says, “Employees who have submitted Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee’s most recently submitted Form W-4.”

Pay special attention to the instructions on the Multiple Jobs Worksheet.

- If you have multiple jobs or you’re married filing jointly and you and your spouse each have one job be sure to complete the multiple jobs worksheet ( page 3 and 4).

Form W-4 Resources

Even though some of the numbers have changed from 2020 to 2021 the directions and the steps have not. You can and should still refer to the video if you have questions about how to complete the Form W-4.

The new Form W-4.

The IRS FAQ.

The IRS Form W-4 information page.

We’ll keep you in the loop as the IRS provides additional guidance. Be sure to read, read, and read to better understand the W-4. The FAQs are a wonderful resource to better understand the goals of the new redesign. Be sure you are using the latest Atlantic Payroll Partners New Hire packet as it includes the latest W-4.

How to complete the new Form W-4 (2020 version)

Did you really come here because you want to know how to complete the new Form W-4? Good news, we’ve created a really simple video that will walk you through the steps for various tax situations.

View step by step guide as a pdf: W-4 Guide

Copyright 2025

Want more? Subscribe to our blog.

Why Atlantic Payroll Partners

The biggest payroll companies probably won’t have time for your business. It’s that simple, you’ll be a number. At Atlantic Payroll Partners, you’ll be the opposite. We’ll know more than your name; we’ll know the names of your children and their birthday’s as well. We will know you.

We’ve been helping Florida business by managing their payroll and providing workers' compensation quotes for ten years. We help keep payroll cost affordable by provided transparent PEO payroll quotes that allow you to plan your budget accordingly. Like the big payroll companies, you can manage your payroll and payroll timekeeping with us, while reaping the benefits of PEO risk management.

Thinking about payroll outsourcing can be scary. Make sure you know what to expect from payroll outsourcing providers; to make the best decision for your business. In addition to offering payroll, and workers' comp quote we offer: Human Resource consultations, Accounting services, and benefits such as, 401ks and Healthcare plans.