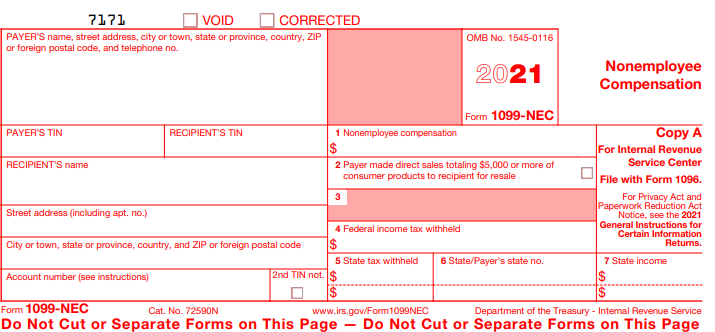

The IRS has introduced a new Form 1099-NEC, Nonemployee Compensation. It’s a sibling to Form 1099-MISC and replaces it for certain purposes.

You must file it for each person in the course of your business to whom you have paid at least $600 during the year for the following:

- Services performed by someone who is not your employee (including parts and materials) (box 1).

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish (box 1).

- Payments to an attorney (box 1).

The IRS has provided additional guidance about what exactly is nonemployee compensation. If the situation meets all four of the following cases, it’s an NEC situation:

- You made the payment to someone who is not your employee.

- You made the payment for services in the course of your trade or business (including government agencies and nonprofit organizations).

- You made the payment to an individual, partnership, estate or, in some cases, a corporation.

- You made payments to the payee of at least $600 during the year.

A partial list of payments that belong on a Form 1099-NEC includes the following:

- Professional service fees, such as fees to attorneys (including corporations), accountants, architects, contractors, engineers, etc.

- Fees paid by one professional to another, such as fee-splitting or referral fees.

- Commissions paid to nonemployee salespersons that are subject to repayment but are not repaid during the calendar year.

- A fee paid to a nonemployee, including an independent contractor, or travel reimbursement for which the nonemployee did not account to the payer if the fee and reimbursement total at least $600. (To help you determine whether someone is an independent contractor or an employee, see Pub. 15-A.)

This is not a complete list, and the choice between the NEC and MISC forms can be confusing. Be sure to keep clear, comprehensive records so your tax professional can help you decide how various payments should be reported. Form 1099-NEC is due on Jan. 31 or the next business day if that date falls on a weekend or holiday.

Copyright 2025

Why Atlantic Payroll Partners

The biggest payroll companies probably won’t have time for your business. It’s that simple, you’ll be a number. At Atlantic Payroll Partners, you’ll be the opposite. We’ll know more than your name; we’ll know the names of your children and their birthday’s as well. We will know you.

We’ve been helping Florida business by managing their payroll and providing workers' compensation quotes for ten years. We help keep payroll cost affordable by provided transparent PEO payroll quotes that allow you to plan your budget accordingly. Like the big payroll companies, you can manage your payroll and payroll timekeeping with us, while reaping the benefits of PEO risk management.

Thinking about payroll outsourcing can be scary. Make sure you know what to expect from payroll outsourcing providers; to make the best decision for your business. In addition to offering payroll, and workers' comp quote we offer: Human Resource consultations, Accounting services, and benefits such as, 401ks and Healthcare plans.

At times, you may want to suddenly change an hourly employee’s work schedule to better suit your business needs. However, several jurisdictions have enacted predictive scheduling laws to prevent certain employers from changing hourly employees’ schedules without giving advance notice.

On Nov. 25, 2014, San Francisco passed the first predictive scheduling law, called ‘The Formula Retail Employee Rights Ordinances.’

The San Francisco law requires covered retail chains to give employees their work schedules two weeks in advance. Covered employers who change an employee’s schedule without giving at least seven days’ advance notice must provide the employee with “predictability pay” (a penalty) — unless an exception applies.

Several other jurisdictions across the country have passed, or are considering, predictive scheduling laws. Most of these laws exclusively target larger employers in the retail, hospitality and food services industries.

Per an article published by the Society for Human Resource Management, “As justification for this disparate treatment, legislators have pointed to the disproportionate number of low-wage workers present in these industries who they believe warrant greater protection.”

Currently, the following jurisdictions have enacted predictive scheduling laws:

- San Francisco (effective July 3, 2015).

- Emeryville, California (effective Jan. 1, 2018).

- Chicago (effective July 1, 2020).

- New York (effective May 30, 2017).

- Oregon, statewide (effective Aug. 8, 2017).

- Philadelphia (effective April 1, 2020).

- Seattle (effective July 1, 2017).

Further, states such as Vermont and New Hampshire have passed “flexible working arrangements” laws. While these aren’t actual predictive scheduling laws, they give employees the right to request scheduling changes and encourage employers to consider these requests.

Predictive scheduling rules vary by jurisdiction, but often have the following components:

- Advanced notice of work schedules.

- Written estimate of the number of hours the employee will likely be scheduled to work.

- Predictability pay if adequate advance notice isn’t given.

- Exceptions to the predictability pay requirements.

- Posting rules.

- Breaks or rest periods between work shifts.

- Record-keeping criteria.

COVID-19 exception

During the COVID-19 pandemic, many businesses had to close or radically modify employees’ work schedules.

As stated in an article published by SHRM, “The [predictive scheduling] laws in many jurisdictions provide exceptions to the notice rules and penalties when acts of nature or other circumstances outside the employer’s control hinder operations.” The COVID-19 pandemic likely qualifies as an exception.

State restrictions

States such as Arkansas, Georgia, Iowa and Tennessee have passed laws banning their local governments from enacting employment-related or scheduling laws. In such states, employers do not have to abide by predictive scheduling laws unless the state or federal government mandates it.

Generally speaking, industry observers expect more states and local governments to enact predictive scheduling legislation. Therefore, employers should be on the lookout for new developments. Make sure you are well versed in the rules governing your business in your jurisdiction.

Copyright 2025

Why Atlantic Payroll Partners

The biggest payroll companies probably won’t have time for your business. It’s that simple, you’ll be a number. At Atlantic Payroll Partners, you’ll be the opposite. We’ll know more than your name; we’ll know the names of your children and their birthday’s as well. We will know you.

We’ve been helping Florida business by managing their payroll and providing workers' compensation quotes for ten years. We help keep payroll cost affordable by provided transparent PEO payroll quotes that allow you to plan your budget accordingly. Like the big payroll companies, you can manage your payroll and payroll timekeeping with us, while reaping the benefits of PEO risk management.

Thinking about payroll outsourcing can be scary. Make sure you know what to expect from payroll outsourcing providers; to make the best decision for your business. In addition to offering payroll, and workers' comp quote we offer: Human Resource consultations, Accounting services, and benefits such as, 401ks and Healthcare plans.

Created December of 2020

After many long, anxiety-filled months, Covid-19 continues to be a factor in how safe people feel as they navigate the current world order. Businesses across the spectrum are creating a new normal with this reality as a dominant factor.

Two prominent issues regarding Covid-19 and workplace safety are worth revisiting as the season changes and the virus still shows no clear signs of abating.

Can employers require employees to be vaccinated?

The first issue concerns flu vaccines.

- Many people are wary of being vaccinated.

- This is of particular importance as flu season nears and the development of an approved Covid-19 vaccine approaches.

- Can employers legally force employees to take vaccines when it is for the greater good of the company?

- Do personal rights prevail?

- The short answer is that a company probably cannot force compliance, but the true answer lies in state law, the Americans with Disabilities Act and the Occupational Safety and Health Administration.

- In most states, employers can terminate employees at will unless the reason for the termination is illegal or prohibited by employment contracts or collective bargaining agreements.

- In general, it is unlikely that vaccinations are specifically mentioned.

- Exemption requests based on religious beliefs or underlying health conditions need to be seriously considered.

- In most situations, the most prudent policy is requesting that employees get vaccinated but not requiring it.

This issue will arise again when a Covid-19 vaccine becomes available. Recent polls show that as many as 50 percent of Americans will be reluctant to take the vaccine even when it becomes available. This may become an issue for employers who want to get back to “normal” as quickly as possible.

Employers should consult an employment attorney before setting any company-wide policy regarding vaccines.

What responsibility do employers have if an employee tests positive for Covid-19?

Covid-19 is more active in some parts of the country than in others, but there are cases everywhere. Employers need to have an action plan in place in the event one of their employees or a volunteer or contractor (collectively referred to as employees in the following text) tests positive for the virus. The following five steps should be part of the plan:

- Employers should check CDC guidelines, state law and any collective bargaining agreements to ensure that they are compliant and enforcing the latest guidance.

- Any employee tests who positive, even if asymptomatic, or shows Covid-19 symptoms while at work or within 48 hours of being at work should be sent home and instructed to self-isolate for 10 days. Testing may be required before the person can come back to work. The person may be required to have a negative Covid-19 test, a positive antibody test or meet other requirements before returning to the workplace.

- The employee’s workspace should be thoroughly sanitized after the employee leaves and should not be used for the next 24 hours, if possible.

- Contact tracing is important to controlling the spread of the disease. The employer should notify all coworkers who were in contact with the infected worker in the two days before the time when infection was confirmed, but employers must ensure that they comply with all federal and state privacy laws when doing so.

- Follow all CDC and state health department guidelines for more specific information. In addition, employers should consult with their employment attorneys to ensure that they are being compliant while limiting their exposure to potential future litigation.

Again, the two biggest issues are health and legal. Stay up to date on work related COVID-19 issues here.

Copyright 2025

Why Atlantic Payroll Partners

The biggest payroll companies probably won’t have time for your business. It’s that simple, you’ll be a number. At Atlantic Payroll Partners, you’ll be the opposite. We’ll know more than your name; we’ll know the names of your children and their birthday’s as well. We will know you.

We’ve been helping Florida business by managing their payroll and providing workers' compensation quotes for ten years. We help keep payroll cost affordable by provided transparent PEO payroll quotes that allow you to plan your budget accordingly. Like the big payroll companies, you can manage your payroll and payroll timekeeping with us, while reaping the benefits of PEO risk management.

Thinking about payroll outsourcing can be scary. Make sure you know what to expect from payroll outsourcing providers; to make the best decision for your business. In addition to offering payroll, and workers' comp quote we offer: Human Resource consultations, Accounting services, and benefits such as, 401ks and Healthcare plans.

Updated 10/21/2021

As of 9/30/2021 the government is no longer providing a credit for paying an employee while they are ill with Covid or taking care of someone with Covid.

Updated 1/13/2021

As of 12/31/2020 the mandate that required employers to provide COVID-19 related leave expired. It is now a voluntary and employers can still receive credit through March 31, 2021. Read more here.

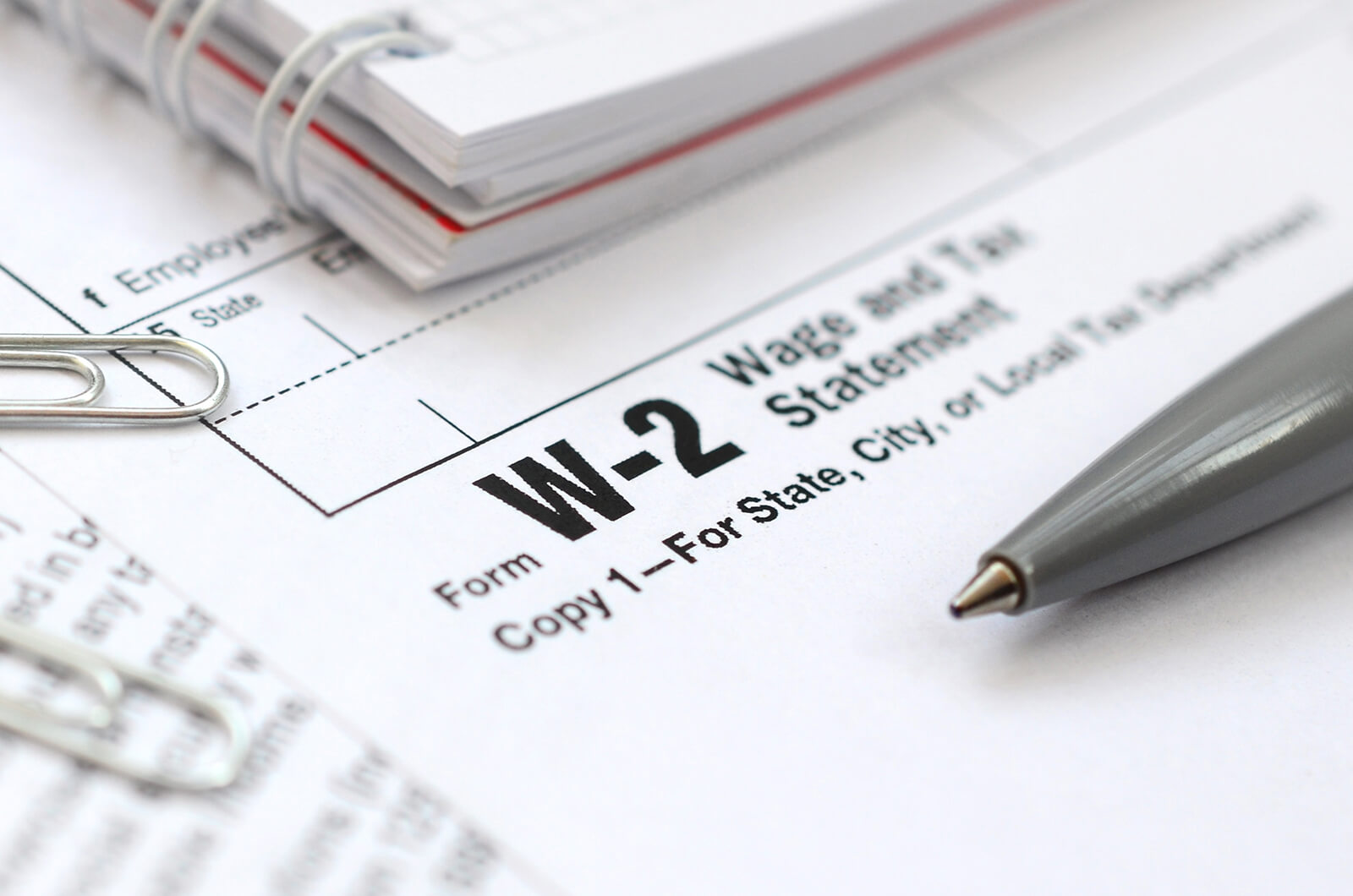

Have any of your employees taken COVID-19 sick leave? If so reporting Covid-19 sick leave on W-2s is something you need to be aware of this year. In Notice 2020-54, the IRS explains how employers must report qualified leave given under the Families First Coronavirus Response Act (FFCRA).

For FFCRA reporting purposes, qualified leave refers to emergency sick leave and expanded family leave paid to employees between April 1, 2020, and Dec. 31, 2020.

General reporting criteria

Employers must report FFCRA-qualified leave in Box 14 of the recipient’s 2020 Form W-2 or on a separate statement. Regardless of which method you choose, you must state the type of FFCRA leave that the employee took and the amount of wages they received for the leave.

For leave pertaining to the FFCRA’s Emergency Paid Sick Leave Act (EPSLA), the IRS says you can use the following, or similar, language:

- Sick leave wages subject to the $511 per day limit (because of care the employee required).

- Sick leave wages subject to the $200 per day limit (because of care the employee provided to another).

For leave pertaining to the FFCRA’s Emergency Family and Medical Leave Expansion Act (EFMLEA), the IRS says you can simply describe it as:

- Emergency family leave wages.

Whether the leave relates to the EPSLA or the EFMLEA, don’t forget to state the amount of qualified leave actually paid to the employee.

Providing additional information to employees

You can provide employees with additional information on the FFCRA leave reported in Box 14 of their W-2 or in the separate statement. You’re not required to give this additional information, but you can if you want to.

When providing additional information, you may follow the “model language” offered in Notice 2020-54. Just remember to modify the notice’s language as necessary.

You may also use the notice’s “model language” to explain what employees should do if they also have self-employment income and intend to claim equivalent credits for qualified sick or family leave.

Separate statements

If you report FFCRA leave in a separate statement and will be giving the employee a paper W-2, you must include the separate statement with the paper W-2.

However, if you will be issuing the W-2 electronically, you must deliver the separate statement at the same time and in the same manner as the electronic W-2.

Reporting Social Security and Medicare wages

FFCRA-qualified leave wages are subject to normal tax withholding — including for federal income tax, Medicare tax and Social Security tax — and must therefore be included in Box 1, Box 3 and Box 5 of the employee’s Form W-2.

Deadline for reporting and distributing 2020 Form W-2s

Employers have until Feb. 1, 2021, to file 2020 Form W-2s with the Social Security Administration to give employees their copies of the form.

See Notice 2020-54 or contact your financial professional for more information on how to report FFCRA-qualified leave.

Benefits of working with a PEO

If you are working with a PEO, like Atlantic Payroll Partners this isn’t something that you’ll need to worry about. We handle your payroll and W-2 filings. However, it is important that you report to us any leave that relates to COVID-19. Doing so will allow us to accurately send out 2020 W-2s.

Copyright 2025

Why Atlantic Payroll Partners

The biggest payroll companies probably won’t have time for your business. It’s that simple, you’ll be a number. At Atlantic Payroll Partners, you’ll be the opposite. We’ll know more than your name; we’ll know the names of your children and their birthday’s as well. We will know you.

We’ve been helping Florida business by managing their payroll and providing workers' compensation quotes for ten years. We help keep payroll cost affordable by provided transparent PEO payroll quotes that allow you to plan your budget accordingly. Like the big payroll companies, you can manage your payroll and payroll timekeeping with us, while reaping the benefits of PEO risk management.

Thinking about payroll outsourcing can be scary. Make sure you know what to expect from payroll outsourcing providers; to make the best decision for your business. In addition to offering payroll, and workers' comp quote we offer: Human Resource consultations, Accounting services, and benefits such as, 401ks and Healthcare plans.